Hi,

Sorry again that its been so long since I posted. I'm just not finding myself all that motivated lately to track and post the numbers. I have been saving and paying down debt with the same intensity, so its not debt fatigue, its more budgeting fatigue. Although looking at my numbers I haven't been living outside of my means. I haven't touched the MasterCard in more than 2 months (other than paying it down!) and I've paid off the balance on the Visa before its due, so no interest is charged (only purchasing things that can only be purchased online - like tickets). I am still imputing my debit transactions into a tracking program, but I haven't imputed the numbers into excel or my "virtual jars". I'm just not motivated, I will admit it. Hopefully with September, my Gail Club will be in more full swing and will give me the push I need to keep doing what I should be doing to be in better control of my money. Until then, I will use the excuse that its summer and I'm going to be lazy!

TTFN, Morgaine.

Sunday, August 15, 2010

Wednesday, July 28, 2010

Sorry!

So sorry I haven't blogged in forever, I've had a lot on my mind! I'm totally in wedding planning mode! Even though its at least 2 years away! Of course, the main thing for me is doing it on a budget! So, I will share with the blogosphere my journey to a budget-conscience wedding.

All ready I've had offers for a friend to take our photos (he's semi-professional, he did our friend's wedding 2 years ago and I saw the pics and they were terrific!) we haven't discussed financials yet, maybe at the engagement party. And another friend offered to do our wedding cake, again no financials, I just sent her a pic of what I'm looking for and we'll see.

We're looking at venues that will be $6000 or less for about 80 people. This weekend we're going to Fantasy Farm in Toronto, I think they may be out of the price range, but I'm willing to talk to the coordinator and get prices and what not. The great thing about doing this now (ie 2 years ahead) is that I won't feel pressured to make a decision. The fiancee said the other day: "I don't want you to fall in love with a place and want to book it right away, we don't have a deposit yet!" I find I really make the worst impulse purchases when I feel rushed so that's why I want to give myself plenty of time.

Also, I bought a book: "The DIY Bride" by Khris Cochran and its got lots of ideas for DIY projects for the wedding. I'm hoping to save some serious cash by doing the following myself (and/or with my Mom and wedding party): invitations, centerpieces, boutonnieres, favours, place settings, guestbook, jewelry, programs, thank you cards, and bouquets! Maybe more. Again time is on my side here :)

As for rest of my money, I will admit that I've fallen off the tracking wagon, however, I haven't gone overboard in my spending as of late (even on the trip, hooray!) except on a few wedding books and magazines. I hope to get caught up by the end of this weekend. Oh, and a tally of what I spent on the trip as well.

Ok, back to wedding planning! TTFN, Morgaine.

All ready I've had offers for a friend to take our photos (he's semi-professional, he did our friend's wedding 2 years ago and I saw the pics and they were terrific!) we haven't discussed financials yet, maybe at the engagement party. And another friend offered to do our wedding cake, again no financials, I just sent her a pic of what I'm looking for and we'll see.

We're looking at venues that will be $6000 or less for about 80 people. This weekend we're going to Fantasy Farm in Toronto, I think they may be out of the price range, but I'm willing to talk to the coordinator and get prices and what not. The great thing about doing this now (ie 2 years ahead) is that I won't feel pressured to make a decision. The fiancee said the other day: "I don't want you to fall in love with a place and want to book it right away, we don't have a deposit yet!" I find I really make the worst impulse purchases when I feel rushed so that's why I want to give myself plenty of time.

Also, I bought a book: "The DIY Bride" by Khris Cochran and its got lots of ideas for DIY projects for the wedding. I'm hoping to save some serious cash by doing the following myself (and/or with my Mom and wedding party): invitations, centerpieces, boutonnieres, favours, place settings, guestbook, jewelry, programs, thank you cards, and bouquets! Maybe more. Again time is on my side here :)

As for rest of my money, I will admit that I've fallen off the tracking wagon, however, I haven't gone overboard in my spending as of late (even on the trip, hooray!) except on a few wedding books and magazines. I hope to get caught up by the end of this weekend. Oh, and a tally of what I spent on the trip as well.

Ok, back to wedding planning! TTFN, Morgaine.

Thursday, July 15, 2010

In Alberta and . . . Engaged!

This is the first time I've been able to post since getting here to Alberta. Right now we're in Banff and its seriously beautiful! Today I got a total surprise, my boyfriend proposed! I totally wasn't expecting it! So, the planning and saving will begin! I hope to post again soon, we've been doing a lot of driving and traveling. More details to follow. So excited!!! :D

Saturday, July 10, 2010

Gail Picnic!

Going to see again my own personal heroine, Gail Vaz-Oxlade! If you don't read her blog and are interested in personal finance, you are missing out A LOT! Til Debt do us Part is one of my favourite shows on TV (also, Big Bang Theory, How I met your mother, and Big Brother) I've watched every episode at least twice (some maybe 4-5 times!)

Anyways, the followers of her blog get together (mostly through the help of Saver Queen) at High Park in Toronto and Gail shows up too! It was a great time last year and I'm totally looking forward to it!

Anyways, time to head out! :) TTFN, Morgaine.

Anyways, the followers of her blog get together (mostly through the help of Saver Queen) at High Park in Toronto and Gail shows up too! It was a great time last year and I'm totally looking forward to it!

Anyways, time to head out! :) TTFN, Morgaine.

Friday, July 9, 2010

Where the Money Stands - Mid July 2010

Here's where my money stands this month:

Own: $607.56 TFSA ($507.56 emergency and $100 gifts fund)

$3469.59 RRSP

Total: $4077.15

Owe: $8457.00 consolidation loan

$9575.00 MasterCard

Total: $18,032.00

Net Worth: -$13,954.85

Change since Jan 2010: +$5,315.60

Its very exciting to see that my Net Worth is now under the negative $14K mark, hard to believe it was almost -$20K at the beginning of the year! Also, my total debt is almost under $18K which is good as well. Keeping track like this is definitely motivating me to keep on truckin' with my debt repayment and savings.

TTFN, Morgaine.

Own: $607.56 TFSA ($507.56 emergency and $100 gifts fund)

$3469.59 RRSP

Total: $4077.15

Owe: $8457.00 consolidation loan

$9575.00 MasterCard

Total: $18,032.00

Net Worth: -$13,954.85

Change since Jan 2010: +$5,315.60

Its very exciting to see that my Net Worth is now under the negative $14K mark, hard to believe it was almost -$20K at the beginning of the year! Also, my total debt is almost under $18K which is good as well. Keeping track like this is definitely motivating me to keep on truckin' with my debt repayment and savings.

TTFN, Morgaine.

Thursday, July 8, 2010

Bi-Weekly Update - June 24 to July 7

Here are my bi-weekly numbers:

So, as you can plainly see, I was REALLY bad last month!!! Over in both Clothing (no gifts in there! OUCH!) and Entertainment. I feel like I wouldn't be spending money in clothing if it wasn't for losing weight. Not, that I'm going to stop my weightloss challenge (I refuse to say diet!) just so I can not spend money on clothes, but it just feels frustrating. Entertainment was over because of a $120 share of a new camera, plus, its summer, its fun time! Oh, well.

This month will probably also be a spendy month since we are going on a vacation. Now, I wouldn't normally even think about going on a trip while in debt, but it is for the bf's sister's wedding, so, its kind of a must. Also, the bf realizes that the only reason we are making this trip is because of him, so he's paying for most of the expenses (hotel, car rental, food) and I paid for my flight (in cash with a travel fund!) and spending money - no more than $200 (I hope!) So, the financial impact for me isn't as huge. It will be really nice to get away from the stifling heat of Toronto right now too (33 degrees Celsius plus humidity). I am looking forward to the time away from work - which has been SUPER stressful right now (only 3 more months of this contract, then I'm FREE!) This is a good time mentally to go away, probably not the best time financially, but everything is booked.

I will try and post again before the trip with a rundown of what we are doing (I have to go over this with the bf since he booked everything) and then of course how it went when I get back. I may be able to get a post or two in from Alberta since I'm bringing my laptop, but it will depend on free internet and how tired I am.

Hopefully things will get better in August! TTFN, Morgaine.

So, as you can plainly see, I was REALLY bad last month!!! Over in both Clothing (no gifts in there! OUCH!) and Entertainment. I feel like I wouldn't be spending money in clothing if it wasn't for losing weight. Not, that I'm going to stop my weightloss challenge (I refuse to say diet!) just so I can not spend money on clothes, but it just feels frustrating. Entertainment was over because of a $120 share of a new camera, plus, its summer, its fun time! Oh, well.

This month will probably also be a spendy month since we are going on a vacation. Now, I wouldn't normally even think about going on a trip while in debt, but it is for the bf's sister's wedding, so, its kind of a must. Also, the bf realizes that the only reason we are making this trip is because of him, so he's paying for most of the expenses (hotel, car rental, food) and I paid for my flight (in cash with a travel fund!) and spending money - no more than $200 (I hope!) So, the financial impact for me isn't as huge. It will be really nice to get away from the stifling heat of Toronto right now too (33 degrees Celsius plus humidity). I am looking forward to the time away from work - which has been SUPER stressful right now (only 3 more months of this contract, then I'm FREE!) This is a good time mentally to go away, probably not the best time financially, but everything is booked.

I will try and post again before the trip with a rundown of what we are doing (I have to go over this with the bf since he booked everything) and then of course how it went when I get back. I may be able to get a post or two in from Alberta since I'm bringing my laptop, but it will depend on free internet and how tired I am.

Hopefully things will get better in August! TTFN, Morgaine.

Friday, July 2, 2010

HST - Boo!

Well, the HST is officially in effect here in Ontario, and all I have to say is - BOO!!! I have to change my budgeted amounts to compensate for the fact that my gym fees are now being charged HST. They went from $109.52 to $117.85 which is way to much to pay for the gym (it includes nutritional counselling, which I finished months ago but they prorated it over the year). Once my membership is up (end of September), I will NOT be renewing it. Yes, I was using it an average of 2-3 times per week for most of the year, but its just way too expensive. The bf and I discovered a rec centre a couple of blocks away from our apartment that has a pool and a gym that is $52 for the whole year!!! We thought it was one of those little family centres, so we hadn't put much thought into looking to see what they had there, but I will definitely be joining up there as soon as my gym membership is gone. That will give me a bit more wiggle room at the end of the month, which will be awesome.

We don't drive, so the HST attached to gas won't affect us that much, except when we go up north to visit the bf's family. It won't be on groceries, so that's good, although we are anticipating a rise in groceries anyways - as my bf puts it, "the groceries are brought in by trucks, the trucks have to buy gas, the gas will now have HST, therefore groceries will be more expensive". I'm not sure how else the HST is going to affect us, but I will post here when I find out!

In other "bad" news, I spent $82.48 on clothes today! Oops :S Its really only because I'm losing weight and I need to replace key pants in my wardrobe, otherwise I wouldn't be bothering. Yesterday I couldn't keep my pants up! I know it would be cheaper to buy belts than new pants, but I really hate belts, and its not just in the waist. In fact, the waist is still a bit tight in some pants (which should mean I can wear these pants a bit longer in the weight loss process) but the butt and legs are extremely droopy in most pants and it looks horrible. I think it was because I was buying Reitman's 16 plus (petites) pants and now regular 16 (petite) fit better, so the plus must have had extra room in the butt and legs, which is now annoying. At least I got everything on sale! A pair of jean capris for $22.99 (regular $45), a pair of work silver capris $30 (regular $36), and two lace camisoles (to wear under cardigans or v-neck sweaters) for $10 each.

I also realized that I didn't put any money on my MasterCard last month! Again, something I've been working on getting under control for quite a while now. I put $22.45 on the Visa, but paid that off before the billing cycle ended. I just have to keep this up and I will feel like I may have finally got the credit monkey off my back. We'll see.

This weekend, I will be going to a street festival tomorrow (maybe $20 in spending?) and then a Renaissance festival (yes, I am THAT geeky!) on Sunday - $22.65 for the ticket and maybe $10 for food? Should be fun, though! TTFN, Morgaine.

We don't drive, so the HST attached to gas won't affect us that much, except when we go up north to visit the bf's family. It won't be on groceries, so that's good, although we are anticipating a rise in groceries anyways - as my bf puts it, "the groceries are brought in by trucks, the trucks have to buy gas, the gas will now have HST, therefore groceries will be more expensive". I'm not sure how else the HST is going to affect us, but I will post here when I find out!

In other "bad" news, I spent $82.48 on clothes today! Oops :S Its really only because I'm losing weight and I need to replace key pants in my wardrobe, otherwise I wouldn't be bothering. Yesterday I couldn't keep my pants up! I know it would be cheaper to buy belts than new pants, but I really hate belts, and its not just in the waist. In fact, the waist is still a bit tight in some pants (which should mean I can wear these pants a bit longer in the weight loss process) but the butt and legs are extremely droopy in most pants and it looks horrible. I think it was because I was buying Reitman's 16 plus (petites) pants and now regular 16 (petite) fit better, so the plus must have had extra room in the butt and legs, which is now annoying. At least I got everything on sale! A pair of jean capris for $22.99 (regular $45), a pair of work silver capris $30 (regular $36), and two lace camisoles (to wear under cardigans or v-neck sweaters) for $10 each.

I also realized that I didn't put any money on my MasterCard last month! Again, something I've been working on getting under control for quite a while now. I put $22.45 on the Visa, but paid that off before the billing cycle ended. I just have to keep this up and I will feel like I may have finally got the credit monkey off my back. We'll see.

This weekend, I will be going to a street festival tomorrow (maybe $20 in spending?) and then a Renaissance festival (yes, I am THAT geeky!) on Sunday - $22.65 for the ticket and maybe $10 for food? Should be fun, though! TTFN, Morgaine.

Wednesday, June 23, 2010

EarthQuake!!!

So, I was at work today and around 1:30 pm we all feel our building moving! Now, I work in downtown T.O. and we all thought at first that it might have been a bomb, considering the G20 is happening in Toronto this week. Well, I think we were the only ones to be relieved to hear it was an earthquake instead!

As for the G20, I haven't been affected directly yet. The only strange thing is a bit less people (more people than I thought, actually) and WAY more police and security. We have a back up plan in place in case we can't get to work tomorrow or Friday. And, of course we are planning to stay as far away from downtown during this weekend as possible. I, personally, have not seen or been to a protest. So, it still seems business as usual to me.

In money related news, not too much to talk about lately and work has been extremely busy so I haven't had much time to budget, blog, or even read other people's blogs. I'm way behind. I'm hoping to catch up this weekend. I need some downtime :S

TTFN, Morgaine.

As for the G20, I haven't been affected directly yet. The only strange thing is a bit less people (more people than I thought, actually) and WAY more police and security. We have a back up plan in place in case we can't get to work tomorrow or Friday. And, of course we are planning to stay as far away from downtown during this weekend as possible. I, personally, have not seen or been to a protest. So, it still seems business as usual to me.

In money related news, not too much to talk about lately and work has been extremely busy so I haven't had much time to budget, blog, or even read other people's blogs. I'm way behind. I'm hoping to catch up this weekend. I need some downtime :S

TTFN, Morgaine.

Sunday, June 13, 2010

Mid Year 2010 Review!

So, its mid-June, half of 2010 is gone! I decided now would be a good time to see how far I've come this year in my savings and debt repayment goals. I'm about half way with my emergency fund goal for 2010 ($1000) - I will be adding more to this in the upcoming years until I have 6 months of essential expenses tucked away. I've also had to deduct money from this account to pay my portion of the trip to Alberta in July, but from now on it will be devoted 100% to emergency fund. After the emergency fund is at $1000, the $100 a month that is going into that account will be diverted into my "Christmas and Gift" fund, which I hope to have $500 by the end of the year.

My RRSP isn't showing a big difference even though I've contributed over $500 to that account! Oh mutual funds and stock market, how you make my life more difficult! (In more ways than one! - my career is in the financial industry, BTW). I may be looking into some different options for my money in the upcoming year, right now I will stick to it.

Student Loan and Visa are PAID OFF!!! I've put $3800 towards my consolidation loan, but its only gone down by $2200 - damn 29.9 interest rate :(((( I've put $1200 towards my MasterCard, but interest, and the fact that I still sometimes use it - I know, bad pf blogger, bad! - it hasn't gone down much at all. But, overall, my debt has gone down by about $5000 so I think that's not too shabby. I just REALLY need to leave that MasterCard alone!!! I'm hoping that at my next review (December) it will have actually gone down by the amount I've put on it (less interest of course, boo). Credit Gods, please give me strength! ;)

TTFN, Morgaine.

Friday, June 11, 2010

Bi-Weekly Report May 27 - June 9

Here is the bi-weekly numbers for May 27 - June 9

Again, most of the spending happened at the end of May: bf's birthday present and dinner. June is definitely going to be a month where I will be reigning in the spending - big time!

I've decided to start a "Christmas" fund (really = "gifts fund") but I won't be putting any money into it until after we get back from our trip in July. I have a tentative goal of $500 but I don't think I'll have that by Christmas if I'm only putting $25 per pay in this account, but at least it'll be something. Luckily, there won't be much more in the way of gifts for a while, besides my share of the wedding gift ($50) in July. September I have two friend's birthdays (they're twins), October is my Godmother's birthday (she's my favourite aunt, more like a second mom to me, so I always buy her a present), November my Mom's birthday, December my brother's birthday and of course, Christmas. I'm hoping to be a bit more prepared for these occasions hopefully next year, but at least, I can make a start of it this year.

BTW, I hope everyone likes the new blog look and layout. I was wanting a 3 column look for a while since I thought things were just a bit too squished. I really like how it looks now :) TTFN, Morgaine.

Again, most of the spending happened at the end of May: bf's birthday present and dinner. June is definitely going to be a month where I will be reigning in the spending - big time!

I've decided to start a "Christmas" fund (really = "gifts fund") but I won't be putting any money into it until after we get back from our trip in July. I have a tentative goal of $500 but I don't think I'll have that by Christmas if I'm only putting $25 per pay in this account, but at least it'll be something. Luckily, there won't be much more in the way of gifts for a while, besides my share of the wedding gift ($50) in July. September I have two friend's birthdays (they're twins), October is my Godmother's birthday (she's my favourite aunt, more like a second mom to me, so I always buy her a present), November my Mom's birthday, December my brother's birthday and of course, Christmas. I'm hoping to be a bit more prepared for these occasions hopefully next year, but at least, I can make a start of it this year.

BTW, I hope everyone likes the new blog look and layout. I was wanting a 3 column look for a while since I thought things were just a bit too squished. I really like how it looks now :) TTFN, Morgaine.

Thursday, June 10, 2010

Rolling in the Dough - Well, not for too long . . .

So, today is THE day: raise, monthly bonus, semi-annual bonus, oh and HST rebate (didn't even know about that one until today!) and guess what, all of that is already almost gone :(

First thing, my raise equalled an extra $6.97 per paycheque - oh well, every little bit counts! The monthly bonus was low as the markets sucked last month and it was slow in general $184.80 net. But, the bonus hurt, why? It was $1200 gross, and I had assumed about $300 would be taken off for taxes, giving me about $900 to put on the debt. But oh no, the bonus came to $783.53 net!!! $416.47 taken off for taxes etc. So, I had to rejig the debt repayment to $1250 instead of $1500 that I had planned :( But still, the balance for the consolidation loan now sits at $8,542.72 so it is coming down.

I'm going to wait until all the bills have gone through the account before I update the bi-weekly budget and post my new numbers. I'm also going to do a mid-year progress report once all the numbers are updated, and see how far I've come.

BTW, I HAVE to leave my Mastercard alone!!! It is not going down, because I keep putting stuff on it. If I had not put any purchases on it since the begining of the year it would be down by about $1000! Instead its down $300. Do NOT touch this card! Do NOT touch this card! Do NOTTTTTTTTTTTT touch this CARD!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!! I have to say this many times I think. Actually, the worse thing is that it is the same bank as my bank account, which allows me to do balance transfers = cash advances. Oh no, bad, very bad. But I really don't want to go through the hassle of changing banks, and I know no one else is going to give me a credit card. So, I just have exert more willpower!

Wish me luck! TTFN, Morgaine.

First thing, my raise equalled an extra $6.97 per paycheque - oh well, every little bit counts! The monthly bonus was low as the markets sucked last month and it was slow in general $184.80 net. But, the bonus hurt, why? It was $1200 gross, and I had assumed about $300 would be taken off for taxes, giving me about $900 to put on the debt. But oh no, the bonus came to $783.53 net!!! $416.47 taken off for taxes etc. So, I had to rejig the debt repayment to $1250 instead of $1500 that I had planned :( But still, the balance for the consolidation loan now sits at $8,542.72 so it is coming down.

I'm going to wait until all the bills have gone through the account before I update the bi-weekly budget and post my new numbers. I'm also going to do a mid-year progress report once all the numbers are updated, and see how far I've come.

BTW, I HAVE to leave my Mastercard alone!!! It is not going down, because I keep putting stuff on it. If I had not put any purchases on it since the begining of the year it would be down by about $1000! Instead its down $300. Do NOT touch this card! Do NOT touch this card! Do NOTTTTTTTTTTTT touch this CARD!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!! I have to say this many times I think. Actually, the worse thing is that it is the same bank as my bank account, which allows me to do balance transfers = cash advances. Oh no, bad, very bad. But I really don't want to go through the hassle of changing banks, and I know no one else is going to give me a credit card. So, I just have exert more willpower!

Wish me luck! TTFN, Morgaine.

Thursday, June 3, 2010

May was Awful!

Those are my numbers for May. As you can see I went WAY over in the Clothing/Gifts and Entertainment categories. We went up north and it was my bf's birthday month, so we did a lot of spending. Luckily, June is looking to be a lot quieter. I'm also going to try and save, save, save for our trip to Alberta in July. The bf is paying for the majority of the trip (hotels, car rentals, food), I paid for my airfare (well, I paid the bf back) and I will need some funds for some food, entertainment, and gifts. I'm thinking about $250 all in.

I'm also glad that once this trip is over, all the money I've been throwing into ING will be for my efund and not for travel. Once that hits $1000, I'm moving $100 per paycheque to RSP and in the new year I have to see if I have to throw more money in the RSP depending on where my taxes stand at that point. But, that's a while in the making.

I CAN'T wait until my next paycheque, monthly bonus + quarterly bonus + raise = awesome debt payment!!! Since I only have $60 to last me until next Thursday, this week has been extremely non-spending. I actually haven't spend any money since Saturday! If only I could behave like this when I actually have money, I would be in such a better situation. Well, I'm learning. I hope! TTFN, Morgaine.

Friday, May 28, 2010

Raise and Semi-Annual Bonus! SWEET!!!

So, I get to work today and on my desk is a letter from HR, I got a raise! Ok, a very little one, but considering I'm on contract, I never even contemplated getting a raise. Its 1.48% which equals from $38,000 to $38,562 or from $20.88 an hour to $21.19, so starting June 10th, I will have to adjust my budget again to reflect the new numbers.

But, even BETTER is that I'm getting a semi-annual bonus of $1200!!! Plus my regular monthly bonus - which should be around $300 - its ALL going on the consolidation loan. I can't wait to post the new balance of the loan and my net worth. I'm so excited!!!

On another front, this weekend is the bf's birthday weekend and its going to be a bit costly, methinks. But, considering he usually pays for the fun stuff, I definitely think I should have no problem spending some money on him for a change. I'll post the numbers after the weekend.

I did make a charge on my Visa yesterday - going to see author Roddy Doyle (author of the novel that was adopted into one of my favourite movies of all time "The Committments"). The ticket is $30 - which I paid off the credit card right away - back to zero lickety split! LOVE IT!!! I'm feeling really good about my ability to keep this credit card at zero.

Anyways, just watching the clock tick down until this week is over and on to the weekend! Indian food and MacGruber await! TTFN, Morgaine.

But, even BETTER is that I'm getting a semi-annual bonus of $1200!!! Plus my regular monthly bonus - which should be around $300 - its ALL going on the consolidation loan. I can't wait to post the new balance of the loan and my net worth. I'm so excited!!!

On another front, this weekend is the bf's birthday weekend and its going to be a bit costly, methinks. But, considering he usually pays for the fun stuff, I definitely think I should have no problem spending some money on him for a change. I'll post the numbers after the weekend.

I did make a charge on my Visa yesterday - going to see author Roddy Doyle (author of the novel that was adopted into one of my favourite movies of all time "The Committments"). The ticket is $30 - which I paid off the credit card right away - back to zero lickety split! LOVE IT!!! I'm feeling really good about my ability to keep this credit card at zero.

Anyways, just watching the clock tick down until this week is over and on to the weekend! Indian food and MacGruber await! TTFN, Morgaine.

Wednesday, May 26, 2010

Bi-Weekly Report May 13-26

Ok, so here are my mid-month May numbers:

Again, I fiddled around with the numbers to make it work. I think, I'm really just going to worry about the monthly numbers - and of course, not spend more money than I have. Here, for example, you can see I had $386.33 left over for my variable expenses (after fixed expenses, debt repayment and savings are taken out) but I spent $353.98 so even though I techinally went over my bi-weekly expenses allotment, I didn't spend more money than I have. Phew!

Payday is tomorrow, and its looking that starting tomorrow, its going to be a very expensive weekend! Tomorrow is a work "night out" (i.e. drinking on a patio), apparently the office manager is paying??? But then I still have to eat out for dinner because I'm going to see a friend's school play (my friend is a teacher) right after, also, have to pay for the tickets for that. Friday = eating out again. Saturday = eating out and movie, since its bf's birthday weekend, I'm paying for all that! And, of course his present! $100 for a new suitcase for our trip to Alberta in July. Once this weekend is over, I'm hoping to take it really easy money (and food!) wise. Since we went up north this weekend, we didn't get any groceries. So, I've eaten out a LOT this week, and will continue until Sunday - when we get more groceries. At least, there are some healthier food choices in the local food courts :)

I'll write more about the "damage" of this weekend when its all over. TTFN, Morgaine.

Again, I fiddled around with the numbers to make it work. I think, I'm really just going to worry about the monthly numbers - and of course, not spend more money than I have. Here, for example, you can see I had $386.33 left over for my variable expenses (after fixed expenses, debt repayment and savings are taken out) but I spent $353.98 so even though I techinally went over my bi-weekly expenses allotment, I didn't spend more money than I have. Phew!

Payday is tomorrow, and its looking that starting tomorrow, its going to be a very expensive weekend! Tomorrow is a work "night out" (i.e. drinking on a patio), apparently the office manager is paying??? But then I still have to eat out for dinner because I'm going to see a friend's school play (my friend is a teacher) right after, also, have to pay for the tickets for that. Friday = eating out again. Saturday = eating out and movie, since its bf's birthday weekend, I'm paying for all that! And, of course his present! $100 for a new suitcase for our trip to Alberta in July. Once this weekend is over, I'm hoping to take it really easy money (and food!) wise. Since we went up north this weekend, we didn't get any groceries. So, I've eaten out a LOT this week, and will continue until Sunday - when we get more groceries. At least, there are some healthier food choices in the local food courts :)

I'll write more about the "damage" of this weekend when its all over. TTFN, Morgaine.

Friday, May 21, 2010

Declined.

Just heard back from the bank, I was declined for the consolidation loan. Their reasoning: they think its too risky for them to take on my debt.

I'll admit that I'm disappointed but was kind of expecting it. It was a shot in the dark, after all. I still wonder why they made me go to all that trouble just to be declined. CIBC is weird, I guess. Oh well, I just gotta keep trudging on and try again in November.

I'm done work for today, happy long weekend (again)! TTFN, Morgaine.

I'll admit that I'm disappointed but was kind of expecting it. It was a shot in the dark, after all. I still wonder why they made me go to all that trouble just to be declined. CIBC is weird, I guess. Oh well, I just gotta keep trudging on and try again in November.

I'm done work for today, happy long weekend (again)! TTFN, Morgaine.

Happy Long Weekend!

I probably won't be posting this week's numbers until maybe Monday or Tuesday. But I do have a few updates. 1) I sent away for my credit report from Equifax - they have on file that I had lost my wallet so they can't verify me over the internet, I had to fax them 2 pieces of government ID to get my report. Once received, I will go about "fixing" it. The rep from CIBC said that my student loan isn't showing as paid off and closed, and of course the verifying the ID part is annoying and this is from 2003!!! I'm hoping to get this notice taken off.

Another update, apparently my RSP isn't doing as well as I thought. I thought I had $3700 but I only have $3000!!! Apparently one of my mutual funds have taken a bit of a hit. So, again its a good thing that I've increased my contributions from $50 to $100 bi-weekly. At least when my funds are down, I can buy more units for less and hopefully those more units will be worth more soon!

So, plans for the weekend are we are going up north to bf's home town. We usually don't spend a lot when we're there, except that T has to rent a car since we don't own one currently. On the plus side, T now has a CC that pays for his rental insurance (that used to be an extra $150 a weekend!!!) so the biggest expense is usually food, we pretty well eat out all 3 meals for the 3 days! Although, considering I am on weight watchers, I may at least take my Special K cereal with me so I have at least one meal covered. This weekend shouldn't end up costing me much more than $50.

I spoke with the bank rep again yesterday, still no word either way about my loan, so I guess I have to hold my breath a little longer. If I don't hear anything by Wednesday next week, I'll call again.

I hope everyone has an amazing long weekend!!! TTFN, Morgaine.

Another update, apparently my RSP isn't doing as well as I thought. I thought I had $3700 but I only have $3000!!! Apparently one of my mutual funds have taken a bit of a hit. So, again its a good thing that I've increased my contributions from $50 to $100 bi-weekly. At least when my funds are down, I can buy more units for less and hopefully those more units will be worth more soon!

So, plans for the weekend are we are going up north to bf's home town. We usually don't spend a lot when we're there, except that T has to rent a car since we don't own one currently. On the plus side, T now has a CC that pays for his rental insurance (that used to be an extra $150 a weekend!!!) so the biggest expense is usually food, we pretty well eat out all 3 meals for the 3 days! Although, considering I am on weight watchers, I may at least take my Special K cereal with me so I have at least one meal covered. This weekend shouldn't end up costing me much more than $50.

I spoke with the bank rep again yesterday, still no word either way about my loan, so I guess I have to hold my breath a little longer. If I don't hear anything by Wednesday next week, I'll call again.

I hope everyone has an amazing long weekend!!! TTFN, Morgaine.

Tuesday, May 18, 2010

Declined?

So, I went into the bank yesterday to speak to a rep about the possibility of a consolidation loan (one that is not at 29.9%!!!) We went over everything, he told me how much interest (10% fixed for 5 years) and the payments ($203 bi-weekly) and the insurance, etc then he sent it through and it came back . . . declined! All that work for declined? Seems really strange to me. I had applied for a consolidation loan with another bank 6 months ago and they declined me right away. We didn't go through all the paperwork and hoopla wasting my time and the reps just to be declined. Anyways, the reason I put a question mark at the end of declined, is that the rep thought that I should have been approved (apparently my debt service ratio just squeaked in under 40%) so he's going to send a note to the underwriters and see if that helps. He said he'd give me a call in the next two business days to tell me either way.

If I'm not approved, I'll just keep going the way that I have and try again in 6 months. By then I hope to have both the citi and mastercard down quite a bit and my credit score should improve. The rep yesterday said that my credit score was pretty good, so it seems that it has improved since I had checked it in January and it was pretty low - although he did say to call and get my student loan to show as paid in full and closed because its not showing that way on my credit report. So, I may even be able to get a better interest rate than 10% from the bank in 6 months, BUT I will still be paying the exhorbitant rate at citi for the next 6 months.

Please keep your fingers crossed for me! TTFN, Morgaine.

If I'm not approved, I'll just keep going the way that I have and try again in 6 months. By then I hope to have both the citi and mastercard down quite a bit and my credit score should improve. The rep yesterday said that my credit score was pretty good, so it seems that it has improved since I had checked it in January and it was pretty low - although he did say to call and get my student loan to show as paid in full and closed because its not showing that way on my credit report. So, I may even be able to get a better interest rate than 10% from the bank in 6 months, BUT I will still be paying the exhorbitant rate at citi for the next 6 months.

Please keep your fingers crossed for me! TTFN, Morgaine.

Friday, May 14, 2010

May - Paycheque 1

May is going to be a busy month! Let's see: bf's birthday, going up north, baby shower, nice weather = bars with patios! I'm budgeting about $100 for bf's birthday present - he wants a new piece of luggage for our trip to Alberta in the summer - and about $50 for his birthday dinner (for himself and I). Around $25 for baby shower gift (splitting it with a friend!) and about $10 for the ingredients for spinach dip (my friend that is having the baby LOVES my spinach dip ;)) This weekend we already got a pizza $5 was my share, and we're going out tomorrow night to a pub with a patio. The trip up north shouldn't cost much as this is to visit the bf's family and friends, he mostly pays - I'll budget about $50 for food and entertainment. Hopefully these things won't break the bank!

Here's where the money stands as of right now:

Oh, and I may be able to get a consolidation loan at a bank, I spoke to a representative and they needed to verify my income and ID before saying if I would be approved - but why make me go through that if they were just going to decline me??? Anyways, it would be a huge relief to not pay 29.9% interest!!!

I've got a money group meeting on Sunday - anyone who lives in the T.O. area and would be interested in joining a money group - email me at morganofthefairies@hotmail.com

TTFN, Morgaine

Here's where the money stands as of right now:

Oh, and I may be able to get a consolidation loan at a bank, I spoke to a representative and they needed to verify my income and ID before saying if I would be approved - but why make me go through that if they were just going to decline me??? Anyways, it would be a huge relief to not pay 29.9% interest!!!

I've got a money group meeting on Sunday - anyone who lives in the T.O. area and would be interested in joining a money group - email me at morganofthefairies@hotmail.com

TTFN, Morgaine

Wednesday, May 12, 2010

April wasn't as bad as I thought!

Ok, try as I might, I just can't seem to fight the clothing bug! So, I've rejigged the budget numbers (yet again) because I just don't spend as much money on entertainment and food as I thought - and more on clothes and gifts then I wished I did!

So, here's the breakdown of April - with new budget numbers (ok, so it seems that I rejigged it to come in balanced in the clothing and gifts category, and I guess that would be correct, but I still spend way under what I projected that I was going to in every other category - so there!) Oh, and keeping in mind that it was a 3 paycheque month!

And here is my goal budget for May:

This is the budget that I'm going totry STICK TO from now on. I think its the most reflective of what I do spend my money on while not going crazy - by that I mean still paying off a lot of debt and meeting my fixed expenses payments and saving. Speaking of saving - I increased my bi-weekly RSP contribution to $100 (up from $50). With the bonuses I've been getting, I'm a little worried that I may have to pay tax next year - ouch! So, I'm going to try and offset this a bit by increasing RSP. By next February I should be able to see if I need to make a larger lump sum to offset taxes by the RSP deadline.

Tomorrow's payday! Huzzah! (I almost didn't make it - $14.16 left in the account today - whew!) TTFN, Morgaine.

So, here's the breakdown of April - with new budget numbers (ok, so it seems that I rejigged it to come in balanced in the clothing and gifts category, and I guess that would be correct, but I still spend way under what I projected that I was going to in every other category - so there!) Oh, and keeping in mind that it was a 3 paycheque month!

And here is my goal budget for May:

This is the budget that I'm going to

Tomorrow's payday! Huzzah! (I almost didn't make it - $14.16 left in the account today - whew!) TTFN, Morgaine.

Wednesday, May 5, 2010

Surveys

Since I started reading PF blogs I decided to start participating in online surveys. So, its been about a year and I've gotten:

$50USD from global test market

$50USD from opinion outpost (although I don't get surveys from them anymore for some reason???)

$50CDN from Angus Reid (just got it today!!!)

Two free boxes of coffee for my dolce gusto coffee maker from Ipsos

$10CDN on amazon from Ipsos

Not bad and I'm more than half way to getting another $50 from GTM, its not too much work but it also takes a long time to get up to the amount of money to cash out. I'm also with survey winnings and toluna but I found those surveys are few and far between (and the points to reward ratios are not that great). So I don't do all their surveys anyways. Oh, and swagbucks - I'm sorry but not really worth my time as far as I can see. Instead of using swagbucks to search I have the airmiles toolbar at home and since the bf and I want to use airmiles for our honeymoon I have to collect as many as I can!

If you're looking to make a few extra snowflakes for debt repayment/saving then its not a bad way to make a few extra dollars without too much effort. Now to deposit my Angus Reid cheque! TTFN, Morgaine.

$50USD from global test market

$50USD from opinion outpost (although I don't get surveys from them anymore for some reason???)

$50CDN from Angus Reid (just got it today!!!)

Two free boxes of coffee for my dolce gusto coffee maker from Ipsos

$10CDN on amazon from Ipsos

Not bad and I'm more than half way to getting another $50 from GTM, its not too much work but it also takes a long time to get up to the amount of money to cash out. I'm also with survey winnings and toluna but I found those surveys are few and far between (and the points to reward ratios are not that great). So I don't do all their surveys anyways. Oh, and swagbucks - I'm sorry but not really worth my time as far as I can see. Instead of using swagbucks to search I have the airmiles toolbar at home and since the bf and I want to use airmiles for our honeymoon I have to collect as many as I can!

If you're looking to make a few extra snowflakes for debt repayment/saving then its not a bad way to make a few extra dollars without too much effort. Now to deposit my Angus Reid cheque! TTFN, Morgaine.

Tuesday, May 4, 2010

Emergency Fund

I'm thinking of changing my goal for my Emergency Fund. Right now I have the goal set to $3000 which I think will be a good "end goal" and I'm thinking to change it for $1000 for 2010 and then concentrate on debt repayment/other savings (i.e. Gift fund). I also really want to hit my $5000 goal in my RSP for this year then $10,000 next year so that I have my $10,000 to put in for a house (I know that I can take $20K out of my RSP for first time homebuyers, but I think that will take waaaaay too long). Also, my aunt has offered to lend us $10K for a down payment as well, so that would be $30K altogether for a downpayment which would be 10% of a $300K home which I think is pretty good.

I'm updating my bars accordingly. I'm also not blogging as often because I'm broke and therefore, don't have much to write about! TTFN, Morgaine.

I'm updating my bars accordingly. I'm also not blogging as often because I'm broke and therefore, don't have much to write about! TTFN, Morgaine.

Sunday, May 2, 2010

End of April - Beginning May

So my last April pay spills into the first two weeks of May, so here's my "End of APril 0 Beginning "May" budgt:

As you can see, there is already a shortage. Because I had to put an extra payment on my Mastercard to make up the $398 minumum payment (OUCH again!!!) and the payment to make up the $1300 payment to my consolidation loan. I basically have $93.85 in cash instaead if the $225 I usually budget myself for my variable expenses. So, I'm making this my challenge: make it to the next paycheque putting as little as possible on the credit card - it will be almost impossible to amke it through without putting anything on, and I already have - I put dinner with my mom on it on Friday (hence the $55 in the food categiorty in the credit colunm). Again I've allocated $0 for clothing and gifts- I will be spending enough on gifts by the end of May though, bf's birthday is on the 28th - at least Mother's Day ais over as far as the gift is concerned. Oh, and there is the May 24 weekend - going up north to bf's hometown - but I usually don't spend much there at all.

So, I'm not really going to give myself anymore challenges for now, I think this will be enough of a challenge - at least for the first two weeks. TTFN, Morgaine.

As you can see, there is already a shortage. Because I had to put an extra payment on my Mastercard to make up the $398 minumum payment (OUCH again!!!) and the payment to make up the $1300 payment to my consolidation loan. I basically have $93.85 in cash instaead if the $225 I usually budget myself for my variable expenses. So, I'm making this my challenge: make it to the next paycheque putting as little as possible on the credit card - it will be almost impossible to amke it through without putting anything on, and I already have - I put dinner with my mom on it on Friday (hence the $55 in the food categiorty in the credit colunm). Again I've allocated $0 for clothing and gifts- I will be spending enough on gifts by the end of May though, bf's birthday is on the 28th - at least Mother's Day ais over as far as the gift is concerned. Oh, and there is the May 24 weekend - going up north to bf's hometown - but I usually don't spend much there at all.

So, I'm not really going to give myself anymore challenges for now, I think this will be enough of a challenge - at least for the first two weeks. TTFN, Morgaine.

Friday, April 30, 2010

Huge Debt Payment Month

In April I have paid:

$1300.00 on consolidation loan (see $5000 off my consolidation loan?)

$398.00 on Mastercard (this was the minimum payment - OUCH!!!)

$127.00 on Visa to pay off mother's day present

Total: $1825.00

Again, though this was not a typical month - I had 3 paycheques and the largest bonus I've gotten yet. Without those things there is no way I would have been able to pay this much.

Next month:

$600.00 to consolidation loan

$200.00 to MC

$65.00 to Visa (signed up for weightwatchers online)

Total: $865.00

Good thing next month's bonus is looking to be quite high - thank you Shelly! TTFN, Morgaine

$1300.00 on consolidation loan (see $5000 off my consolidation loan?)

$398.00 on Mastercard (this was the minimum payment - OUCH!!!)

$127.00 on Visa to pay off mother's day present

Total: $1825.00

Again, though this was not a typical month - I had 3 paycheques and the largest bonus I've gotten yet. Without those things there is no way I would have been able to pay this much.

Next month:

$600.00 to consolidation loan

$200.00 to MC

$65.00 to Visa (signed up for weightwatchers online)

Total: $865.00

Good thing next month's bonus is looking to be quite high - thank you Shelly! TTFN, Morgaine

Wednesday, April 28, 2010

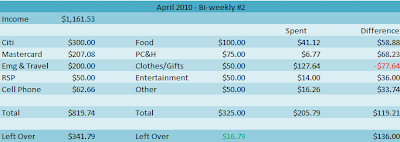

April Bi-Weekly #2 - Final

So, tomorrow is payday, thank goodness! I'm all out of money! I did manage to get to the end of the pay period on less than $40 - I had $10 left which I put on the Mastercard as a "snowflake".

So, not much to report spending wise. I did put something else on credit - I joined weight watchers, but I have gotten the money for that from a co-worker all I have to do is put the payment on.

Tomorrow is my THIRD and last paycheque of the month. Its pretty well allotted 100% so I have to be extra careful not to have my credit card handy or there may be dire consequences! More on that tomorrow (or Friday, depending on how busy I am tomorrow night). TTFN, Morgaine.

So, not much to report spending wise. I did put something else on credit - I joined weight watchers, but I have gotten the money for that from a co-worker all I have to do is put the payment on.

Tomorrow is my THIRD and last paycheque of the month. Its pretty well allotted 100% so I have to be extra careful not to have my credit card handy or there may be dire consequences! More on that tomorrow (or Friday, depending on how busy I am tomorrow night). TTFN, Morgaine.

Friday, April 23, 2010

April Week 3

Here are my April Week 3 numbers:

And here is the month so far:

Not too much change. I ate out Thursday night and today for lunch. Very bad, I know! I had to buy a battery for our camera - 2 = $29.99!!! Its a "special" battery just for our camera, but I need to take pictures of jewelry to put on Etsy, so it was a must, but luckily the bf is going to reimburse me for it since he usually pays for this and who knows how many pictures each person takes anyways.

Plans for the weekend: gym tomorrow and then my mom's for dinner, Indian food for lunch and movie with friends on Sunday with a roast at home for dinner! The reimbursed money from the battery will be going towards Sunday's outing, but it will be worth it to have some fun with my friends.

Happy Weekend Everyone! TTFN, Morgaine.

And here is the month so far:

Not too much change. I ate out Thursday night and today for lunch. Very bad, I know! I had to buy a battery for our camera - 2 = $29.99!!! Its a "special" battery just for our camera, but I need to take pictures of jewelry to put on Etsy, so it was a must, but luckily the bf is going to reimburse me for it since he usually pays for this and who knows how many pictures each person takes anyways.

Plans for the weekend: gym tomorrow and then my mom's for dinner, Indian food for lunch and movie with friends on Sunday with a roast at home for dinner! The reimbursed money from the battery will be going towards Sunday's outing, but it will be worth it to have some fun with my friends.

Happy Weekend Everyone! TTFN, Morgaine.

Sunday, April 18, 2010

April Week 3 so far

Here's how I'm doing so far this bi-weekly period:

Not bad, except in clothing/gifts category. I'm over in this category for this month. So, there goes two of my goals for this month: no clothing, no going over any budget categories. I suppose I could have waited to purchase a few of the items that I bought, but I'm not very good at waiting! Its at least part of the reason that I'm in debt in the first place. The only good thing is that I'm not using credit to purchase these things.

I have $136 left in the bank account to go the next week and a half and I think I can do it, with some left over to boot! We don't really have anything planned for this week - we even have a week of home cooked meals planned! So, I can't imagine that this going to be a pricey two weeks.

Here's where I stand on this month's numbers so far:

Its really too bad that I didn't do a better job of not spending this month, next month will be more expensive with my bf's birthday and going to his hometown on the May 24 long weekend.

Anyways, I'm off to make my lunch for tomorrow and get ready for bed - tomorrow's Monday after all! TTFN, Morgaine.

Not bad, except in clothing/gifts category. I'm over in this category for this month. So, there goes two of my goals for this month: no clothing, no going over any budget categories. I suppose I could have waited to purchase a few of the items that I bought, but I'm not very good at waiting! Its at least part of the reason that I'm in debt in the first place. The only good thing is that I'm not using credit to purchase these things.

I have $136 left in the bank account to go the next week and a half and I think I can do it, with some left over to boot! We don't really have anything planned for this week - we even have a week of home cooked meals planned! So, I can't imagine that this going to be a pricey two weeks.

Here's where I stand on this month's numbers so far:

Its really too bad that I didn't do a better job of not spending this month, next month will be more expensive with my bf's birthday and going to his hometown on the May 24 long weekend.

Anyways, I'm off to make my lunch for tomorrow and get ready for bed - tomorrow's Monday after all! TTFN, Morgaine.

Saturday, April 17, 2010

April Bi-Weekly Report #1

Here are my final numbers for the first two weeks in April:

And here is where I stood in my monthly numbers after 2 weeks:

Not horrible, but certainly more than I wanted to spend this month. And, of course the worse is yet to come (I spent $127 in clothes on Thursday!) I will post those numbers on Sunday.

Plans for the weekend: Saturday - my bf and I are going to the gym, probably grab lunch out (something healthy I hope!), watch "Clash of the Titans" (not sure about this one, but the bf really wants to see it and I am a Classics buff), and eat dinner at home tonight. Tomorrow, no real plans, I should clean though! Should get groceries and do laundry. Hopefully I can fit a walk in there as well. If the weather isn't too crappy!

TTFN, Morgaine.

And here is where I stood in my monthly numbers after 2 weeks:

Not horrible, but certainly more than I wanted to spend this month. And, of course the worse is yet to come (I spent $127 in clothes on Thursday!) I will post those numbers on Sunday.

Plans for the weekend: Saturday - my bf and I are going to the gym, probably grab lunch out (something healthy I hope!), watch "Clash of the Titans" (not sure about this one, but the bf really wants to see it and I am a Classics buff), and eat dinner at home tonight. Tomorrow, no real plans, I should clean though! Should get groceries and do laundry. Hopefully I can fit a walk in there as well. If the weather isn't too crappy!

TTFN, Morgaine.

Thursday, April 15, 2010

Paycheque 2 of 3 - PLUS bonus cheque SWEET!

Just a quick post, I spent most of tonight trying to figure out the issues with my money tracking system - fixed!

Anyways, awesome news today - I got my bonus cheque! $353.61 which is the highest bonus I've gotten so far ($501 before they took off taxes - boourns!). It went directly towards my consolidation loan and I also made my "normal" $300 payment and of course $500 from my first paycheque = $1153.61 so far this month on my loan (almost a whole paycheque!) I've decided to just put the extra $146.39 on at the end of the month to equal the $1300 payment I wanted to make this month (see post: "$5000 Off my Consolidation Loan?" on March 29/10). I could put the "normal" $300 but I also want to put $100 on my mastercard to offset some of the interest from last month.

So now my consolidation loan sits at . . . drumroll . . . wait for it . . . $9,989.81!!! Under $10K = AWESOME!!! At the end of the month with my $146.39 the balance will be: $9843.42, so exciting :)

So now both large debts (consolidation loan and mastercard) are under $10K each, my total debt is $19,864.85 - under $20K!!! And, my net worth is now -$15,600.77 that's a POSITIVE difference of $3,469.68 since the beginning of the year. I'm quite happy with this progress. I LOVE my bonuses!

On the negative side - I broke my "no clothing" challenge again. This time MUCH worse than I did last month. I bought a new gym bag, a new laptop bag ($9.99 half price because I bought the gym bag at a BOGO sale), a new pair of jeans (I'll write more about this on my fitness blog Fit for Thirty), two new pairs of work pants (a total steal $11.99 for one and $14.99 for the other), and a sweater. Other than the sweater, those pieces had been on my "want" list for a while. I'll post about that at another time. Total $127.64! BTW, I wore the shirt that made me lose my challenge last month today and its awesome! I buy a lot of clothes, but I do wear 99% of what I buy.

So, my "quick" post turned out not to be so quick. I'll post all the numbers tomorrow.

TTFN, Morgaine.

P.S. Congrats to Krystal @ GimmeBackMyFiveBucks for landing an awesome new job!

Anyways, awesome news today - I got my bonus cheque! $353.61 which is the highest bonus I've gotten so far ($501 before they took off taxes - boourns!). It went directly towards my consolidation loan and I also made my "normal" $300 payment and of course $500 from my first paycheque = $1153.61 so far this month on my loan (almost a whole paycheque!) I've decided to just put the extra $146.39 on at the end of the month to equal the $1300 payment I wanted to make this month (see post: "$5000 Off my Consolidation Loan?" on March 29/10). I could put the "normal" $300 but I also want to put $100 on my mastercard to offset some of the interest from last month.

So now my consolidation loan sits at . . . drumroll . . . wait for it . . . $9,989.81!!! Under $10K = AWESOME!!! At the end of the month with my $146.39 the balance will be: $9843.42, so exciting :)

So now both large debts (consolidation loan and mastercard) are under $10K each, my total debt is $19,864.85 - under $20K!!! And, my net worth is now -$15,600.77 that's a POSITIVE difference of $3,469.68 since the beginning of the year. I'm quite happy with this progress. I LOVE my bonuses!

On the negative side - I broke my "no clothing" challenge again. This time MUCH worse than I did last month. I bought a new gym bag, a new laptop bag ($9.99 half price because I bought the gym bag at a BOGO sale), a new pair of jeans (I'll write more about this on my fitness blog Fit for Thirty), two new pairs of work pants (a total steal $11.99 for one and $14.99 for the other), and a sweater. Other than the sweater, those pieces had been on my "want" list for a while. I'll post about that at another time. Total $127.64! BTW, I wore the shirt that made me lose my challenge last month today and its awesome! I buy a lot of clothes, but I do wear 99% of what I buy.

So, my "quick" post turned out not to be so quick. I'll post all the numbers tomorrow.

TTFN, Morgaine.

P.S. Congrats to Krystal @ GimmeBackMyFiveBucks for landing an awesome new job!

Tuesday, April 13, 2010

Paycheque 1

Sorry about not posting in about a week - the program I use to track my money (Ascendo Money - if anyone is curious) gave me some weird totals when I tried to sync my blackberry. All is fixed now - except on my blackberry, it still has funny numbers. I'm going to try and get into contact with customer support and see if I can get that fixed.

Anyways, after spending pretty well all of my money in the first weekend, I lived off of $40 for 2 weeks, in fact, I still have $10 left with only one day until payday!

So, since I only have $10 left and I don't think I'll be spending it tomorrow, I can post my numbers and feel ok with it.

Here's the Bi-Weekly Budget #1

And here's the monthly numbers (again, keep in mind that since it is a 3 paycheque month, that the numbers are inflated).

I really gotta stop blowing all my money in the first weekend and try and budget my money out to last me two weeks!

Still no clothes or jewelry spending this month (other than reposting listing on Etsy at $10).

Wish me luck! TTFN, Morgaine.

Anyways, after spending pretty well all of my money in the first weekend, I lived off of $40 for 2 weeks, in fact, I still have $10 left with only one day until payday!

So, since I only have $10 left and I don't think I'll be spending it tomorrow, I can post my numbers and feel ok with it.

Here's the Bi-Weekly Budget #1

And here's the monthly numbers (again, keep in mind that since it is a 3 paycheque month, that the numbers are inflated).

I really gotta stop blowing all my money in the first weekend and try and budget my money out to last me two weeks!

Still no clothes or jewelry spending this month (other than reposting listing on Etsy at $10).

Wish me luck! TTFN, Morgaine.

Friday, April 2, 2010

April 2010 - Paycheque 1 of 3 - Whoohoo!

Here's my monthly budget for April 2010 - accounting for the extra paycheque, of course!

And here's my Bi-weekly #1 Budget

I also rejigged the numbers here because I wanted to pay off the visa (again) and make the extra payment to the consolodation loan and my emergency/travel fund (that I withdrew from to pay off my student loan in February - another $100 and it will be back to where it was, plus another $100 at the end of the month and its back to where it would be if I hadn't withdrawn).

April Goals:

I have updated my bars and I'm very happy to see that since October 2009 (when I started tracking) my Net Worth has increased by $2583.06!!! And $1434.54 just since the beginning of last month!!! All the money I have spent paying off debt is finally making a dent. :)

HAPPY EASTER (to those that celebrate). TTFN, Morgaine.

And here's my Bi-weekly #1 Budget

I also rejigged the numbers here because I wanted to pay off the visa (again) and make the extra payment to the consolodation loan and my emergency/travel fund (that I withdrew from to pay off my student loan in February - another $100 and it will be back to where it was, plus another $100 at the end of the month and its back to where it would be if I hadn't withdrawn).

April Goals:

- Pay off $1300 (or more depending on bonus) to consolidation loan

- No money spent on clothes

- No (more) money spent on credit*

- Stay on budget in every category - monthly budget

I have updated my bars and I'm very happy to see that since October 2009 (when I started tracking) my Net Worth has increased by $2583.06!!! And $1434.54 just since the beginning of last month!!! All the money I have spent paying off debt is finally making a dent. :)

HAPPY EASTER (to those that celebrate). TTFN, Morgaine.

Wednesday, March 31, 2010

End of March Review

March Goals:

-No money spent on clothes - NOPE $16.99 on a top $45.18 on accessories

-No money spent on jewelry supplies - NOPE $20.60 ($17 of this I'm getting back from the person buying the jewelry!)

-No money spent on credit!!! - Well, kind of - See below

-Stay on budget in every category - NOPE In fact, I've decided to make some changes to my budget. More on that later.

So, basically I broke ALL of my March Goals. BUT I did pay off my Visa! Well, kind of. I put $111.17 on it for my mother's day gift - ticketmaster only takes credit cards. This will be added to my April gift budget and paid off in April accordingly. I just wanted to make sure I got good (cheap) seats.

Here's how I did for the last two weeks in March, not awesome, but certainly not as bad as the first two weeks of March!

Only over in Personal Care/Household (one category being changed in April) and Clothes, since I budgeted zero for this category, technically I'm not over if I had put my 'normal' clothing budget.

Here's the full month of March:

So, again over in every category except clothes and other. I have some serious re-jigging to do!

I will post again tomorrow with April's budget and goals.

TTFN, Morgaine.

-No money spent on clothes - NOPE $16.99 on a top $45.18 on accessories

-No money spent on jewelry supplies - NOPE $20.60 ($17 of this I'm getting back from the person buying the jewelry!)

-No money spent on credit!!! - Well, kind of - See below

-Stay on budget in every category - NOPE In fact, I've decided to make some changes to my budget. More on that later.

So, basically I broke ALL of my March Goals. BUT I did pay off my Visa! Well, kind of. I put $111.17 on it for my mother's day gift - ticketmaster only takes credit cards. This will be added to my April gift budget and paid off in April accordingly. I just wanted to make sure I got good (cheap) seats.

Here's how I did for the last two weeks in March, not awesome, but certainly not as bad as the first two weeks of March!

Only over in Personal Care/Household (one category being changed in April) and Clothes, since I budgeted zero for this category, technically I'm not over if I had put my 'normal' clothing budget.

Here's the full month of March:

So, again over in every category except clothes and other. I have some serious re-jigging to do!

I will post again tomorrow with April's budget and goals.

TTFN, Morgaine.

Monday, March 29, 2010

$5000 off my consolidation loan?

Next month, since it is a 3 paycheque month, I have scheduled myself to pay $1300 off my consolidation loan.

1st paycheque $300 regular payment + $200 (what normally would go to Mastercard) = $500

2nd paycheque $300 regular payment

3rd paycheque $200 snowball + bonus (this month is will be high, around $3-400!!!) = $500

=$1300 (maybe more depending on bonus)

From May on, the "regular payment" will be around $600 - may fluctuate slightly because of my bonus, but hopefully not much.

April $1300

May $600

June $600

July $600

Aug $600

Sept $1300 - another 3 paycheque month. Even if my bonus isn't as high that month, I will add from the planned spending acct.

Total $5000!!!

Of course, that's not coming completly off the top, there's interest on the loan that I didn't calculate for - too complicated for my blood! But that should be a huge help in becoming debt free!

If my next job doesn't include a bonus, it has to bring me at least $200 more net a month in order to maintain my current payments - hopefully more! :)

TTFN, Morgaine.

1st paycheque $300 regular payment + $200 (what normally would go to Mastercard) = $500

2nd paycheque $300 regular payment

3rd paycheque $200 snowball + bonus (this month is will be high, around $3-400!!!) = $500

=$1300 (maybe more depending on bonus)

From May on, the "regular payment" will be around $600 - may fluctuate slightly because of my bonus, but hopefully not much.

April $1300

May $600

June $600

July $600

Aug $600

Sept $1300 - another 3 paycheque month. Even if my bonus isn't as high that month, I will add from the planned spending acct.

Total $5000!!!

Of course, that's not coming completly off the top, there's interest on the loan that I didn't calculate for - too complicated for my blood! But that should be a huge help in becoming debt free!

If my next job doesn't include a bonus, it has to bring me at least $200 more net a month in order to maintain my current payments - hopefully more! :)

TTFN, Morgaine.

Sunday, March 28, 2010

Non-Spendy Weekend

As I thought, this weekend was not spendy at all! All I've purchased was a salad spinner (finally!) and for $12! I think I will be going to Kitchen Stuff Plus for most of my kitchen needs from now on, they are actually very reasonably priced!

The bf buys groceries so even though we had guests over and I made dinner and desert for 4 people it didn't cost me anything. Today I'm staying home, cleaning up and relaxing - I need it!

Here's a picture of the desert I made yesterday - Boston Cream Cupcakes! So yummy :)

I will post again on Thursday - Payday! Or before if I have something to post.

TTFN, Morgaine.

The bf buys groceries so even though we had guests over and I made dinner and desert for 4 people it didn't cost me anything. Today I'm staying home, cleaning up and relaxing - I need it!

Here's a picture of the desert I made yesterday - Boston Cream Cupcakes! So yummy :)

I will post again on Thursday - Payday! Or before if I have something to post.

TTFN, Morgaine.

Thursday, March 25, 2010

March - Week 3

So far, so good.

The clothes column includes the sweater I bought last Friday and an umbrella (last one went inside out in a particularly nasty storm a while ago) and an insulated lunch bag - so not really "clothes" per se, but I thought it to be the best category to put it in.

The only plans for the weekend so far are having some friends over on Saturday (making dinner) and going to see my Mom on Sunday, so it shouldn't be a spendy weekend. Here's hoping!

TTFN, Morgaine.

The clothes column includes the sweater I bought last Friday and an umbrella (last one went inside out in a particularly nasty storm a while ago) and an insulated lunch bag - so not really "clothes" per se, but I thought it to be the best category to put it in.

The only plans for the weekend so far are having some friends over on Saturday (making dinner) and going to see my Mom on Sunday, so it shouldn't be a spendy weekend. Here's hoping!

TTFN, Morgaine.

Monday, March 22, 2010

Somewhat Spendy Weekend

Well, this weekend was less spendy than last weekend, but its definitely where I would like to be in terms of spending.

Friday: $20 for dinner, $16.99 for sweater

Saturday: $30 for dinner and drinks

Sunday: $10 for dinner, $15.50 movie

Total: $92.49

So, just under $100 in one weekend! At least next weekend will be a lot quieter!

Friday: $20 for dinner, $16.99 for sweater

Saturday: $30 for dinner and drinks

Sunday: $10 for dinner, $15.50 movie

Total: $92.49

So, just under $100 in one weekend! At least next weekend will be a lot quieter!

Sunday, March 21, 2010

So much for "No Clothing March"

On Friday I went to Sears to buy a salad spinner (Asian Pear http://theasianpear.blogspot.com/ made me think about how I wanted one for a while) but instead I bought a sweater! In my defense, its totally me (and cute), I can wear it to work, and it was $14.99 (on clearance from $29.99).

Here it is!

I'm not trying to justify my purchase, but its hard getting over a clothing/shopping addiction! :S

For the rest of the weekend, the bf and I went out to an Irish pub yesterday with some friends (came to about $30 bucks for dinner and drinks) and we're going to see Alice in Wonderland tonight (probably another $20).

I will try and post on Monday how expensive this weekend is, I hope I don't do too much more damage!!!

TTFN, Morgaine.

Here it is!

I'm not trying to justify my purchase, but its hard getting over a clothing/shopping addiction! :S

For the rest of the weekend, the bf and I went out to an Irish pub yesterday with some friends (came to about $30 bucks for dinner and drinks) and we're going to see Alice in Wonderland tonight (probably another $20).

I will try and post on Monday how expensive this weekend is, I hope I don't do too much more damage!!!

TTFN, Morgaine.

Friday, March 19, 2010

2 Down, 2 to go!

Ok, Visa is officially paid off today! So, I have the biggest debts left: consolidation loan and Mastercard. Next, I am concentrating on the consolidation loan. Mostly because it has the higher interest rate, but also since I want to learn how to live within my means, it is too tempting to put the high amount of payment on the MC and then just spend it when I'm "short" on funds or I really want something. Once the consolidation loan is paid off, I'm hoping to have decent emergency and planned spending accounts established so I don't run to the credit card every time I want something. Also, I'm hoping by that point my commitment to being debt-free-forever will be extremely strong so I won't want to go back in the hole ever again (other than a mortgage)!

Maybe also, I will be over my shopping "addiction". I did something potentially very dangerous yesterday - I went shopping! I went into 2 shoes stores, 4 clothing stores, and 1 bead store. But, get this, I didn't buy ANYTHING!!! I was there to look for a particular bead for someone for their wedding, which is close to a strip mall. So of course, I start thinking about all the things I want (new shoes, coat, etc) but I didn't find anything I loved for a good price ($60 for a raincoat!). And, I didn't find the bead either. I was tempted by other beads, but I held out!!! And, since its "No Clothing March" I didn't buy a shirt that I really liked - if in April its on sale, I may consider it, but I may make it a "No Clothing April" as well, we'll see.

BTW, the reason my consolidation loan isn't on the progress bars on the bottom is because I have to call in to find out the balance (during business hours) and since I'm lazy I don't do it very frequently. However, with the new payment ($600-700/mth depending on how high my bonus is) I will try and get an update at least every couple of months to make sure its going well.

I hope everyone has a nice weekend! TTFN, Morgaine.

Maybe also, I will be over my shopping "addiction". I did something potentially very dangerous yesterday - I went shopping! I went into 2 shoes stores, 4 clothing stores, and 1 bead store. But, get this, I didn't buy ANYTHING!!! I was there to look for a particular bead for someone for their wedding, which is close to a strip mall. So of course, I start thinking about all the things I want (new shoes, coat, etc) but I didn't find anything I loved for a good price ($60 for a raincoat!). And, I didn't find the bead either. I was tempted by other beads, but I held out!!! And, since its "No Clothing March" I didn't buy a shirt that I really liked - if in April its on sale, I may consider it, but I may make it a "No Clothing April" as well, we'll see.

BTW, the reason my consolidation loan isn't on the progress bars on the bottom is because I have to call in to find out the balance (during business hours) and since I'm lazy I don't do it very frequently. However, with the new payment ($600-700/mth depending on how high my bonus is) I will try and get an update at least every couple of months to make sure its going well.

I hope everyone has a nice weekend! TTFN, Morgaine.

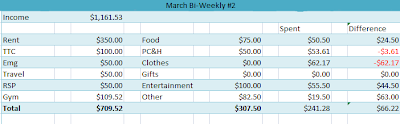

Thursday, March 18, 2010

Payday!

Well, here's how I've done in March so far (not so good!)

So, I overspent in every category except other and clothes. But, please note, I did not put anything on my credit card! The extra was covered from a "savings" account - I guess a planned spending account, but not really planned.

I have at least kept a few of my March goals.

March Goals:

-No money spent on clothes - so far, so good

-No money spent on jewelry supplies - so far, so good

-No money spent on credit!!! BIG ONE - so far, so good

-Stay on budget in every category - NOT going to happen!

This is where I stand on my monthly budget:

So, over in gifts category and I'm sure with such small amounts in the other categories, it would be extremely hard to stay within those amounts. Anyways, here is March Bi-Weekly #2 Budget (not amended for the monthly amounts).

Oh, and did I mention I will have my Visa paid off by the end of the month? My bonus cheque plus my "snowball" payment (i.e. what used to be allocated to student loans) paid it off!!! Once the payment is posted, I will update the bars (and savings/RSP bars).

I hope everyone had an awesome (and not too spendy) St Patrick's Day! Slainte!

TTFN, Morgaine.

So, I overspent in every category except other and clothes. But, please note, I did not put anything on my credit card! The extra was covered from a "savings" account - I guess a planned spending account, but not really planned.

I have at least kept a few of my March goals.

March Goals:

-No money spent on clothes - so far, so good

-No money spent on jewelry supplies - so far, so good

-No money spent on credit!!! BIG ONE - so far, so good

-Stay on budget in every category - NOT going to happen!

This is where I stand on my monthly budget:

So, over in gifts category and I'm sure with such small amounts in the other categories, it would be extremely hard to stay within those amounts. Anyways, here is March Bi-Weekly #2 Budget (not amended for the monthly amounts).

Oh, and did I mention I will have my Visa paid off by the end of the month? My bonus cheque plus my "snowball" payment (i.e. what used to be allocated to student loans) paid it off!!! Once the payment is posted, I will update the bars (and savings/RSP bars).